Your Strategic Financial Partner for Roofing & HVAC

Stop losing money on overlooked overhead and hidden tax traps—let’s fix your finances so you can focus on growing a profitable contracting business.

Running a roofing or HVAC business isn’t just about climbing ladders or fixing AC units—it’s a juggling act of materials, labor costs, tight deadlines, and unpredictable weather. And if you’re not tracking your overhead or planning your taxes year-round, you could be leaving thousands on the table (or worse, losing money without even realizing it).

I’m Mareaka Bunch, an Enrolled Agent with a Master’s in Accounting and over a decade of experience helping contractors just like you. Whether you’re pulling in $500k or looking to hit your first million, I’m here to streamline your accounting, slash your tax bills, and put you firmly in control of your bottom line.

The Real Cost of “Hidden” Mistakes

1. Ignoring Fixed Overhead in Bids

You just bid a job expecting a $10k profit. But when you forget to factor in the $15k of rent, truck expenses, and insurance, guess what? That “$10k profit” actually turns into a $5k loss. If you’re underbidding like this on multiple projects, you’re quietly burning your hard-earned cash.

Why It Matters: Proper overhead allocation can be the difference between healthy margins and “Where did all my money go?”

Our Fix: We set up job costing systems to capture every expense, so you know exactly what each project truly costs.

2. Unreliable Cash Flow Management

An HVAC crew suddenly racks up overtime due to a late-season heatwave—or a roofing job gets delayed by rain. Without a cash flow plan, you’re stuck scrambling to cover payroll while waiting on overdue invoices.

Why It Matters: One unexpected slowdown—or surge—can break your budget if you’re not prepared.

Our Fix: We help you forecast seasonal ebbs and flows, keep a reserve fund, and structure payment terms so you’re never caught empty-handed.

3. Missing Out on Tax Deductions

You buy a new truck mid-year but don’t realize there’s a Section 179 deduction that could’ve wiped out a chunk of your tax bill. Or you neglect to track office space expenses because “it seems too small to matter.”

Why It Matters: Even minor oversights add up—thousands lost here, thousands lost there.

Our Fix: As an EA (Enrolled Agent) and tax specialist, I ensure you leverage every available deduction, credit, and strategy so you only pay what you owe—not a penny more.

Why Work With Me?

I’m not your typical “bean-counter” with a calculator who’s never stepped on a job site.

Over the last 10+ years, I’ve helped companies plug profit leaks, optimize bids, and navigate complex tax rules without the headache.

Here’s what sets my services apart:

Specialization

I live and breathe contractor finances—job costing, overhead allocations, multi-state payroll, and everything else that comes with running a hands-on business.

Hands-On Guidance

Think of me as your virtual CFO—without the six-figure salary. I don’t just send you statements; I walk you through them, pinpointing exactly where you’re bleeding cash or missing a big tax break.

Realistic, Actionable Solutions

You won’t get theory or fluff—just practical advice on paying your crew, managing materials, and optimizing your overhead, so you can turn a profit on every job.

What to Expect from Your Free 30-Minute Profit & Tax Review

Quick Peek at Your Books: We’ll spot-check your accounting records to see if you’re capturing key expenses (fuel, equipment repairs, office overhead) the right way.

Tax Return Overview: We’ll pinpoint any obvious missed deductions, plus evaluate if your current business structure is truly tax-efficient.

Instant Action Steps: Walk away with at least 2–3 recommended tweaks to help you increase your margins and reduce your tax bill—whether we decide to work together or not.

Want to see a live view of how your Profit & Tax Analysis call will go? Check this out 👇

Ready to fix the money leaks and finally feel in control of your numbers?

Is Your Business Leaving Money on the Table?

You’re running a real operation—crews in the field, trucks moving, phones ringing.

But if the profit isn’t showing up like it should, something’s off in the numbers.

Take this quick 5-question, 45-second assessment built for roofing & HVAC business owners.

You’ll walk away with a custom result like:

The Growth Gambler – Revenue’s up, but margin’s shrinking.

The Buried Boss – You’re running everything, but the numbers are running you.

The Exhausted Expert – You’re great at the work—but not supposed to be doing it all.

The Exit Planner – You’ve built something solid. Time to protect it.

👉 Once you’ve got your result, you’ll unlock a free discovery call to dig deeper—with someone who speaks contractor, not corporate.

Take the Assessment → See Where You Stand.

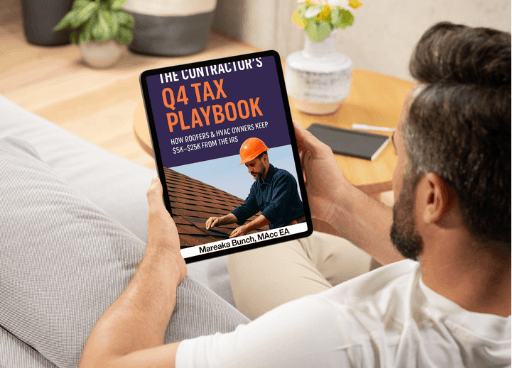

Your Free Q4 Contractor’s Tax Playbook is Here

How roofers and HVAC contractors keep $5-$25K from the IRS.

“I was underbidding roofing jobs for years and didn’t realize my ‘profit’ was disappearing in overhead. After three months of working together, we re-priced my estimates, cut unnecessary costs, and saved me nearly $15k in taxes. Now, I actually see the profit I’ve been chasing.”

Explore

OUR LATEST ARTICLES

Don’t let a single penny slip through the cracks—you’ve worked too hard building your roofing/HVAC business to give profits away to inefficiencies and surprise tax bills. Let’s get you on track.